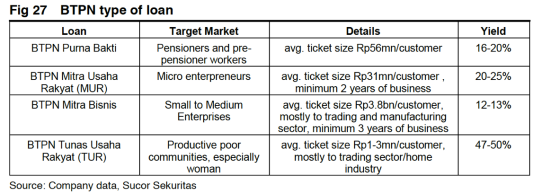

Bank Tabungan Pensiunan Nasional is a Buku III Bank which focuses on the low-income population. It focuses its lending on Pension, MSME, and the Productive Poor.

Shareholders

- Sumitomo Mitsui Banking Corp – 40.0%

- Summit Global Capital Management B.V. – 20.0%

- Treasury Stock – 1.63%

- Public – 38.37%

SWOT Analysis

Good Record in Entering New Businesses

- Note: The drop in ROE in 2015 & 2016 includes Rp180billion and Rp610billion of digital investments, respectively.

Most directors have been with the firm since 2008-09: Jerry Ng, Ongky W. Dana, Djemi Suhenda, Anika Faisal, Kharim Siregar

High NIM, Low NPL…how is it possible?

1.BTPN focuses on the mass market -> high yield loans

2.BTPN usually educate its debtors to increase their knowledge on financial management and business, and provide a network -> reduce NPL

3.Community banking -> close to its customers in villages (unbanked population)

4.Innovative Loan Distribution and Collection

- e.g. loans to women on a “collective borrowing” model

- Increase incentive to pay back to ”save their face”

Earnings Forecast

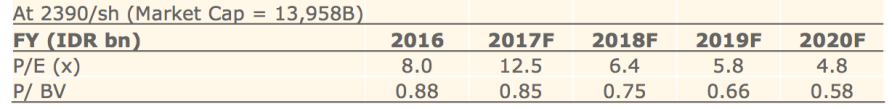

Valuation & Ratio Analysis

I believe CoF will be trending down as Jenius acquires new customers, and as customers get used to using Jenius for its daily transactions, increasing BTPN’s CASA ratio from its current 12%. It is important to note that BTPN has not seen a growth in CASA ratio in the 1 year in which Jenius was released.

Risk to Earnings Forecast

- Higher Loan Growth can increase NIM

- As of 9M2017, BTPN has a Liquid Assets Ratio of 32%. This much excess liquidity suggests BTPN has the ability to grow its loan book. If they do, this can allow them to increase or maintain their NIM (Note current assumption is that NIM will be compressed in the coming years to 10.3% by 2020F)

- Fintech getting a larger share of BTPN’s market

- Like BTPN, many fintech companies are providing loans that many banks are not willing to provide. With a growing number of fintech companies, there is a risk that these companies aggressively expand their market share in the expense of BTPN’s. This is also given the high asset yields of BTPN’s loans which might attract competitors.

2017 Earnings Analysis

Management has reiterated in 2016 that they are willing to have flat or negative growth in net income to fund its digital investments. As of 9M2017, BTPN has spent Rp1.4Trillion for investments in the digitalisation of its processes and customer experience (Rp557bn was spent in the 9 months ending Sep’17). In Q42017, it is predicted that BTPN will have a once-off restructuring cost of Rp700B, mostly related to employee expenses, as BTPN is closing 50% of its branches and is laying off 40% of its employees. As a result, the forecast earnings for FY2017 is Rp1,119B, a drop of -36% YoY.

2018 Outlook

- Expect lower operating expenses

- BTPN plans to close nearly 50% of its branches by the end of 2017 and layoff many workers (the reason for the Rp700bn restructuring costs). Hence, we can expect lower operating expenses from operating branches in 2018.

- In return, BTPN is automating a lot of its loan distribution, collection and processing – which is possible because they have been investing heavily to digitalize its back-end processes as well as front-end (e.g. using BTPN Wow! network for loan distribution & collection)

- Digital investments to continue, but with lower expense growth

- As of Sep’17, Jenius has 359,000 registered customers and is available in Jakarta and Bandung. I believe investments in Jenius will continue to be high as BTPN will spend significant marketing costs as they expand Jenius’ coverage.

- Meanwhile, as of Sep’17, BTPN Wow! has 4.3million customers and 200,000 agents (most number of Laku Pandai agents in the country).

- Digital investment expenses growth should be subdued, as the introduction phase should be over by 2018 (significant costs are required to commercialize these 2 products in introduction phase)

- A Lot of Liquidity

- At 9M2017, Liquid Asset Ratio is at 32%

- This suggests BTPN has the ability to pay a large dividend or engage in a share buyback, if not utilise its liquidity to increase its loan book

- Note: BTPN for the first time paid a dividend of Rp100/sh in 2017

- Focus on Productive Poor (Syariah) and SME loans

- Not much growth in Pension segment due to high competition from Bank Mantap and Bank BRI

- Micro business is downsizing since the introduction of the government subsidised KUR, which management seem to believe does not provide enough yield

- This can increase NPL ratio further than my assumptions (increase to 1.0% NPL in 2019F), and lower asset yield due to increasing size of SME segment

Current net income is understating BTPN’s true earnings power

- BTPN is currently investing heavily in its 2 new businesses, BTPN Wow! and Jenius. Its current earnings would have been materially higher if not for these investments. During the 9 months of 2017, BTPN charged Rp624billion to the income statement for its digital investments and restructuring costs. If we exclude this Rp624billion after-tax, 9M2017 income would have been Rp1,800billion instead of Rp1,367billion. This would lead to a PE ratio of under 6.5.

Analysis of Management

- BTPN’s CEO, Jerry Ng, has been with BTPN since 2008 when TPG Nusantara took control of the company. His track record of ROE, growth and NPL has been fantastic.

- Management has a long-term vision, as supported by its controlling owner’s (Sumitomo) long-term vision for Indonesia. Management is willing to sacrifice short-term performance (by investing for the future) in favour of long-term performance.

Growth potential

- Indonesia’s loan-to-GDP ratio at 37% is the lowest among Asia-pacific countries

- 64% of Indonesia’s adult population still has no bank accounts – a large untapped market for customer acquisition by BTPN Wow! and Jenius

- BTPN still has a low equity-to-assets ratio, giving them large room to grow their loan book

- Synergies between BTPN Wow! and Syariah and other types of financing

- BTPN Wow! users may eventually become Jenius users as they become more affluent

- Pico loans (<Rp1million) – which will compete with fintech companies

Fair Value

To derive a fair value, I will roll-over the valuation to 2018 and use the Gordon Growth Model, assuming:

- 12.5% sustainable ROE for 2018F-2020F

- Reasonable considering BTPN’s ROE history, and the fact that 2016-2017 earnings is significantly weighed by digital investments. (Digital investments: 2016 – Rp610bn, 9M2017 – Rp557bn)

- 10.2% Cost of Equity

- Risk-free rate: 7%, Market Premium: 5%, Beta: 0.64

- BTPN’s earnings resilience in a recession (where many banks suffer large drop in earnings) and conservative lending practices makes a CoE which is lower than the market return reasonable. Also, in the past few years, BTPN has engaged invested heavily in Jenius, BTPN Wow! and other intangible assets which should widen their moat (e.g. for a more stable funding base)

- 5.0% Long-Term Growth Rate

- Reasonable since there is a lot of room for future growth (high under-banked population), and many benefits from digital investments must have yet to be realized in 2018. 5.0% is in line with national economic growth.

Fair Value 2018 = (0.125 – 0.05) / (0.102 – 0.05) = 1.44 x 18,624bn = 26,819bn = Rp4592/sh

My TP reflects 2018P/E of 12.2x and 2018P/BV of 1.44x, which I believe is reasonable valuation given BTPN is a well-run bank in a growing industry.

Today BTPN already reach 4000

LikeLike